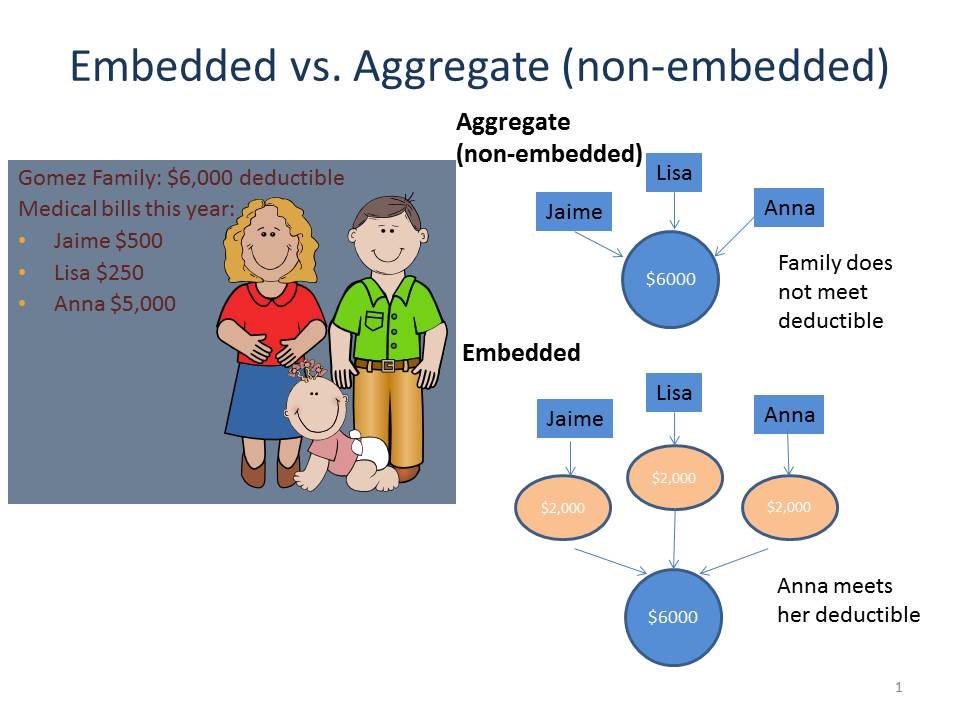

Embedded Deductible Hdhp 2025. For example, for plan years. Importantly, plans that provide family coverage with an embedded deductible* must not pay benefits until the minimum required family deductible of $3,200 is met.

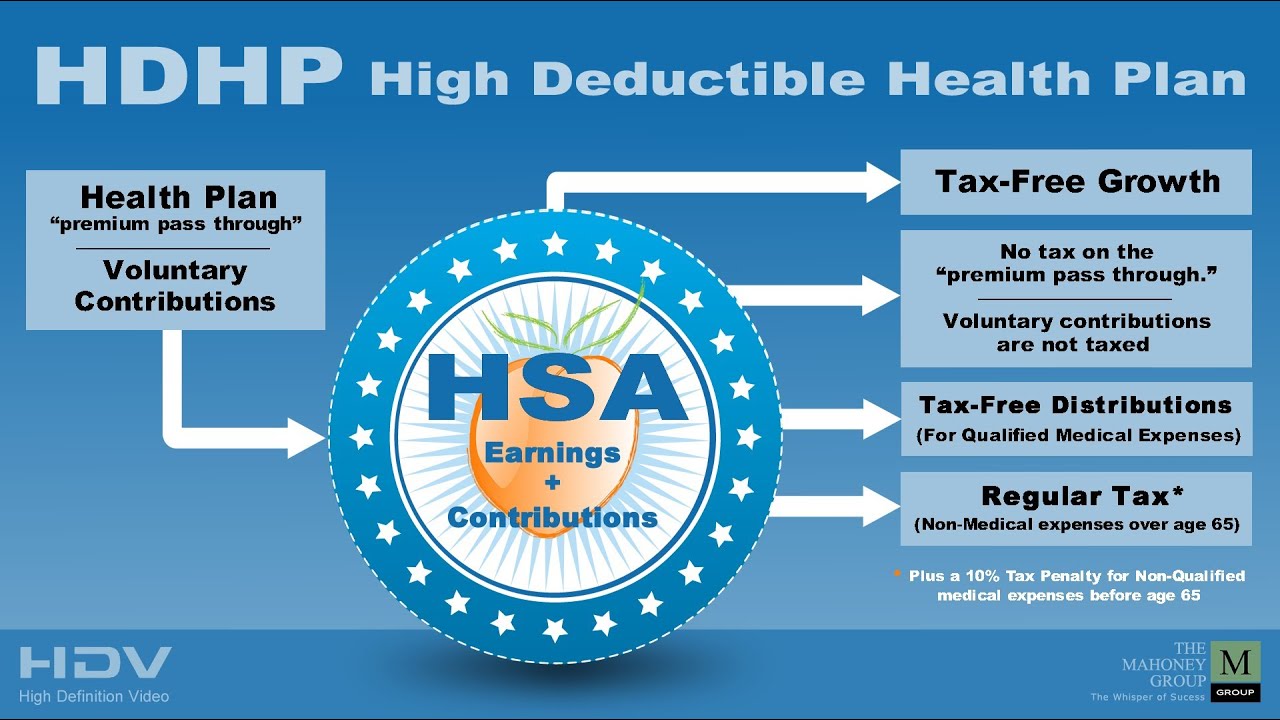

High Deductible Health Plan (HDHP) Meaning, Pros & Cons, Those with family coverage under an hdhp will be permitted to contribute up to $8,300 to their hsas in 2025, an increase from 2025’s $7,750 maximum. An hdhp will not be hsa qualified if it has an embedded.

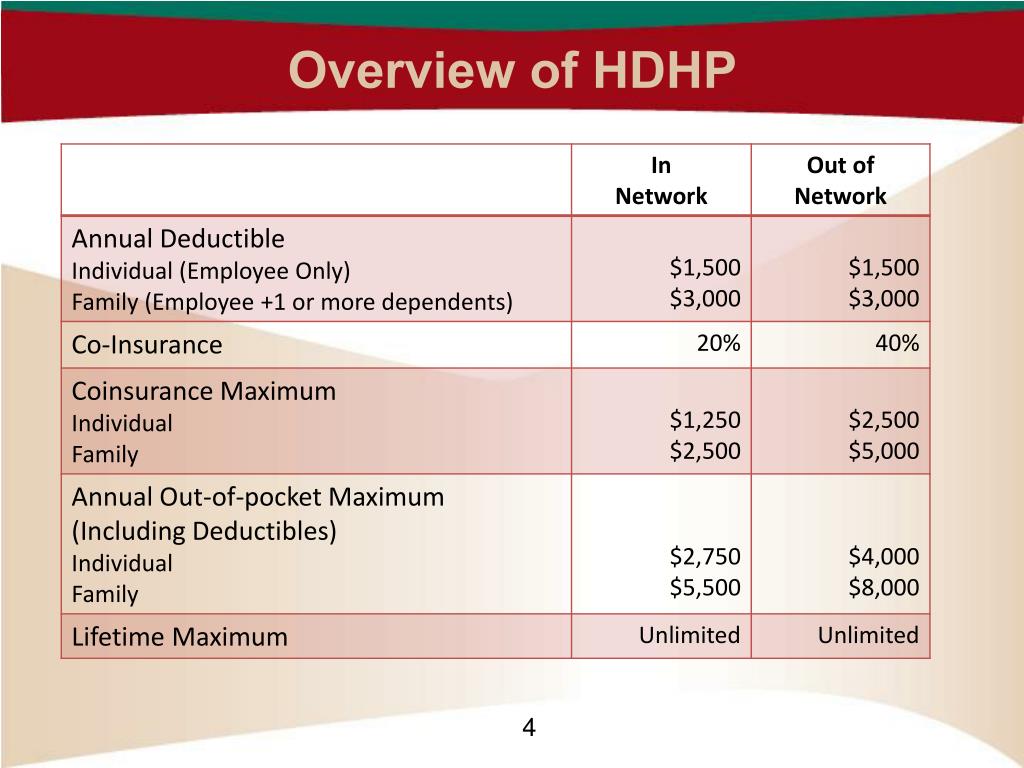

New HSA/HDHP Limits for 2025 Miller Johnson, The minimum annual deductible for a family hdhp is $3,000 for 2025 (2025 limits are not yet available). This means that plans with an.

Embedded Deductibles Source of Consumer Confusion Center on Health Insurance Reforms, For 2025, the minimum deductible amount for hdhps will increase to $1,600 for individual coverage and $3,200 for family coverage. The minimum annual deductible for a family hdhp is $3,000 for 2025 (2025 limits are not yet available).

HDHP High Deductible Health Plan, YouTube, The minimum annual deductible for a family hdhp is $3,000 for 2025 (2025 limits are not yet available). Importantly, plans that provide family coverage with an embedded deductible* must not pay benefits until the minimum required family deductible of $3,200 is met.

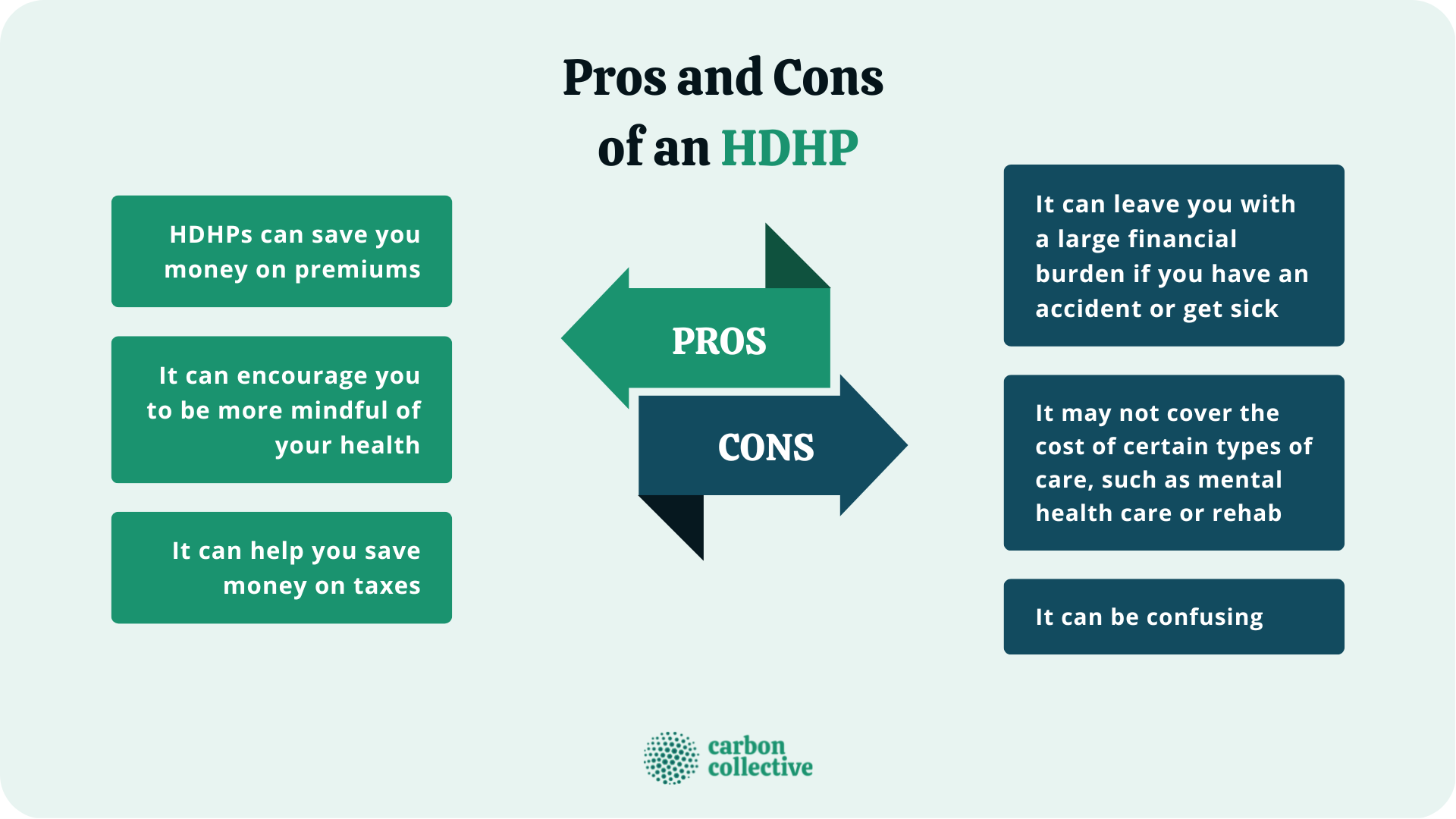

The Pros and Cons of High Deductible Health Plans (HDHPs), The minimum annual deductible for a family hdhp is $3,000 for 2025 (2025 limits are not yet available). Minimum deductible for an individual.

dpc unaffordablecare HDHP deductibles outofpocket ACA iwantdirectcare , Consider 2025 hsa/hdhp and excepted benefits hra limits when finalizing 2025 plan designs. This means that plans with an.

Ask the Benefits Expert High Deductible Health Plans Tandem HR, Changes are effective on the employers' effective or renewal date beginning jan. Consider 2025 hsa/hdhp and excepted benefits hra limits when finalizing 2025 plan designs.

HIGH DEDUCTIBLE HEALTH PLAN (HDHP) HEALTH SAVINGS ACCOUNT(HSA) Insgroup, LLC, An hdhp will not be hsa qualified if it has an embedded. Importantly, plans that provide family coverage with an embedded deductible* must not pay benefits until the minimum required family deductible of $3,200 is met.

PPT High Deductible Health Plan (HDHP) and Health Savings Account (HSA) PowerPoint, If you want an health savings account (hsa), you'll need a high deductible health plan. Plans can be subject to “embedded” or “aggregate” deductibles.

2025 HSA & High Deductible Plan (HDHP) Information M3 Insurance, For example, for plan years. The family minimum deductible increased to $3,200 an increase of $200 from 2025.

Today's Horoscope Virgo 2025. Get your free daily virgo horoscope on horoscope.com. Today promises a curious blend of. Today promises a curious blend of. Virgo daily horoscope today, march 15, 2025:

Harbor Freight Free Item Coupon 2025. Professional top chest for $999. Get any one of these items for free now through sunday at #harborfreight. Harbor freight tools coupon code: Thanks to community member geckohands for finding this deal note, discount is valid for any single item under $10 only.

House Tax Rebate 2025. Maximum tax credit of $15,000; The refund provides property tax relief depending on your income and property taxes. Households are eligible for the council tax rebate if they were liable for council tax on, and lived in, a property in council tax bands a to d as their main home on […]